Changing the Channel: Drones and Robotics Solutions Present Both Challenges and Opportunities to Security Integrators

Over the years, a sales channel has developed in the security industry through which a large percentage of devices reach end users, particularly in the nonresidental market. Drones and robotics are among the newest solutions gaining traction among buyers and potentially offering new business and recurring monthly revenue opportunities for integrators.

In this report, produced by the Security Industry Association’s AI, Drones and Robotics Interest Group with support from Robotic Assistance Devices, explore the challenges and opportunities presented by drones and robotics solutions to security integrators. The report highlights the role of robotics in security, the challenges and benefits presented by autonomous security solutions and how the future of artificial intelligence, robots and drones will change the industry.

Table of Contents

Table of Contents

Introduction

Introduction

Over the years, a sales channel has developed in the security industry through which a large percentage of devices reach end users, particularly in the nonresidential market.

In short, manufacturers provide their products to integrators, value-added resellers and distributors, and they, in turn, make the goods available to businesses and facilities.

With integrators, this often occurs as part of a service contract that also includes installation and maintenance, a model that replaces a one-off sale or project with a partnership that produces recurring monthly revenue (RMR). This approach has proven effective and profitable — even more so as security technologies have been developed that are especially good fits for a subscription model, such as cloud surveillance and access control.

Not all security equipment is sold this way, however. In the residential sector, leading providers sell products and services direct to consumer, and do-it-yourself (DIY) offerings have expanded. With the commoditization of certain video cameras and other devices, DIY systems are also used in some small businesses and organizations.

At the enterprise level, physical security products, historically, have gained market acceptance by first demonstrating value to practitioners. After sufficient demand has developed, companies in the channel are then engaged for installation, service and, eventually, sales to new customers. Drones and robotics are among the newest solutions gaining traction among buyers and potentially offering new business and RMR opportunities for integrators.

The Role of Robotics

The Role of Robotics

Physical security operations generally trend in the direction of using devices and technologies as force multipliers to reduce the level of manpower required. Just as a lock secures an entry point without needing to post a guard and a video camera provides surveil- lance in an area where no security personnel are present, effective advances generally mean that fewer people can do more things.

Drones and robots are yet another iteration of this. The technologies, particularly ground-based robots, have, at times, been judged harshly, but this may be, in part, a function of inappropriate expectations. When a robot is seen as an exact replacement for a person, it is being set up for failure. But when it is understood to be a mobile platform for observation and other sensor and analytic tools that have already been proven effective and that can reduce the number of person-hours required for security operations, its potential use and value become clearer.

The phrase “hybrid autonomy” is sometimes used in discussions of how humans and robots should interact. It replaces the science fiction version of fully autonomous robots with a more realistic vision in which robots carry out some tasks autonomously – typically, as they are often described, the dull, dirty and dangerous ones – and humans leverage those abilities to inform their analysis and decision making and, thus, perform their jobs more effectively. Such hybrid autonomy, it can be argued, has existed since the first electronic labor-saving devices were introduced. The difference now is that the devices are getting “smarter” and more capable.

“Why would you have [security guards] sit there bored out of their mind for hours on end when all the studies in the world show that a human being is good for about eight to 14 minutes worth of work” performing uninterrupted monitoring, one robotics manufacturer asked. “Put them into a position where they’re doing some- thing that is more suited to a human being’s mind, where they’re actually able to use their head, to think strategically, empathize and sympathize with people, and provide services and help, and then put the robots in a situation where they excel, in the boring, monotonous routine.”

A consultant echoed those comments, noting the benefits that can accrue from such a division of labor.

“Robots are highly reliable at collecting and synthesizing massive amounts of data with total recall,” he said. “People are great at quickly analyzing that data and making intelligent and flexible decisions. The combination offers massive productivity and risk management performance value.”

The Challenges

The Challenges

A consultant recalled that, when drones were first introduced, “it was very Wild West.”

“They didn’t know what they didn’t know, and so they just started reaching out and connecting with people and identifying where there were opportunities,” he said. “And they found, in general, better traction going direct with very large companies who had a very significant interest in drones, as well as counter-drone systems.”

The introduction of robotics was not dissimilar, he said.

Though several years have passed since then, manu- facturers have typically continued to find greater success using a direct-to-user approach, largely for three main reasons.

- Selling – and, even more so, servicing – drones and robotics requires a high degree of new technical knowledge. Unlike, say, an update to an existing camera or a control panel, these are new product categories that end users will have many questions about. In order to incorporate the devices as smoothly as possible into security operations, manufacturers work closely with practitioners, especially at the beginning. If integrators are to take on this role, they will need training and education to make them as proficient with a robot as they are with an intrusion alarm.

“If we didn’t have somebody on site for the first six months, the customer would have a completely skewed view of the technology” a manufacturer said. “Non-skilled value-added resellers are no help.”

- Integrators, naturally, seek to provide the prod- ucts and services that their customers want the While interest in drones and robotics has been growing, end user demand likely has not yet reached the critical mass that would persuade integrators to invest the time and resources needed to take on these new technologies.

“[Integrators] are trying to move things that they traditionally move, that are easy to move,” a drones manufacturer noted. “Until there’s a customer that wants this, they’re not going to spend a lot of time on it.”

As with any business, potential profits are a prime motivator for integrators. And given the investments required for additional training, the current limited demand and a technology that does not lend itself to 30-40% margins, the dollars and cents are simply not yet there for them.

“When [integrators] go to sell it, they want huge margins,” a manufacturer said. “And so we tell them, ‘Hey, you can sell it for whatever you want to sell it for, but you have to justify that with your client. You have to present the value that you bring to the table because, I guarantee you, they’re not dumb.”

Despite these challenges, manufacturers also say that as automated security technologies mature and demand increases, they will offer significant potential to integrators to grow their businesses.

The Benefits

The current state of the drone and robotics market and its relationship to the channel is not unlike what has been seen with previous emerging technologies. One manufacturer, in fact, likened it to the transition from analog to IP in the security industry, a move that took some time to be fully embraced but has now become the default.

“It feels like we’re almost seeing the same movie,” he said.

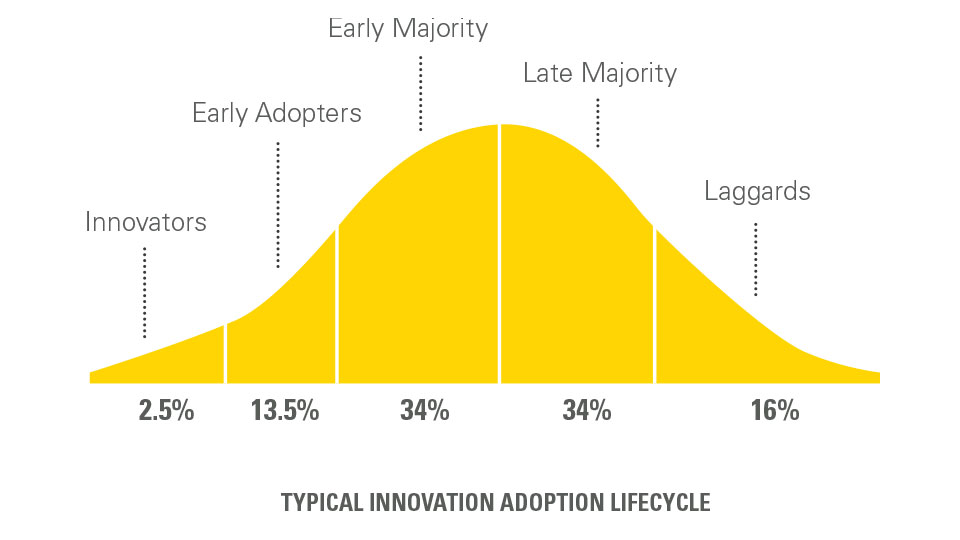

In terms of the standard Innovation Adoption Lifecycle, security robots are likely still in the far-left “Innovators” part of the bell curve, with drones perhaps reaching into the “Early Adopters” section.

For automated security devices to be routinely offered by integrators alongside more traditional security equipment, adoption will have to move significantly farther to the right. Indeed, multiple manufacturers said that change will come from the end point of the channel – that is, demand from practitioners will determine whether the channel regards the technology as worth offering.

“There’s no beachhead” at this point, one said. “End users will drive the shift – 100%.”

This means that the current sales model will likely continue for some time, with manufacturers connecting with and educating more and more end users because, as one drones CEO said, “Market education is best done by the creator of the technology itself. It takes time for a technology to become more prevalent…If I was an integrator, I would wait, as well.”

At the same time, though, representatives of drones and robotics companies note that, as end user demand grows, so will the benefits for potential partners. One of the biggest advantages noted for integrators is that robots need to work with all of the other components of a security system, and integrators are already in the business of making diverse systems function holistically.

“[Robots] need to talk to the environment,” a manufacturer observed. “We view the integrator part as absolutely key…I think it’s a business opportunity for them. How do you make a workplace ready? Almost like for an employee.”

Another echoed this and further noted that automated security devices present a new market opportunity.

“Integrators, for the very first time, can now cross over to the manned guarding space,” he said. “It’s a whole new revenue line…Here’s a way for you to make more money and you’re in a new business where your core competency is a competitive advantage.”

Perhaps most important for integrators, drones and robotics systems offer a new path for recurring revenue.

“Smart systems integrators are seeking ways to create RMR, and in the case of robotics and drones, they can add RMR while having the manufacturer do most of the work,” a consultant said. “It is an outstanding opportunity to leverage their customer base and increase business equity.”

Finally, offering automated security systems can help to future-proof an integration business, so that, in a few years, it will not be in a position equivalent to trying to sell analog equipment in a digital world. One robotics CEO put it bluntly, saying that reluctance to adapt to emerging technologies “is what puts integrators at risk.”

“Change or fade away,” he added.

The Future

Artificial intelligence, the technology that probably has the most critical role in drones and robotics, was the No. 1 Security Megatrend in SIA’s annual look at the 10 biggest trends in the security industry in both 2021 and 2022.

Service models were No. 4 in 2022, and, as one manufacturer said, “Robots are most properly delivered as a service. The core product is not a product but a service.” Two other entries on the 2022 list – increased interoperability and expanded intelligence monitoring – also relate to automated security.

In May 2021, meanwhile, the U.S. Bureau of Labor Statistics published a report on the impact of AI on security equipment and employment. Referring to “the whizbang security technology of the future,” the bureau noted, “As the robot monitoring technologies develop and become more common, they are expected to become more affordable for businesses that need to increase or supplement their security systems.”

It went on to project the impact of automated security on guard services, in particular.

“Security technology is rapidly evolving and becoming more sophisticated, able to analyze image data captured from devices, drone scans, or robots,” the report stated. “The analysis generates more and higher quality information to be acted upon. This information is used to determine if and when a security guard should act…Technology will limit the need for officers to patrol an area where no suspicious activity has been detected, consequently changing the role of security personnel – from less physical patrols to more remote responses whenever suspicious activity occurs.”

This “hybrid autonomy,” as referenced earlier, is how, even though a robot cannot be a full replacement for a human guard, the force multiplier effect that it provides means that “fewer guards will be needed to patrol the same area as before.” This has already resulted in some guard companies partnering with robotics firms.

“We’re not here to replace all human guards,” a manufacturer said. “Will some be replaced? Will the hiring of some be impossible because of inflation? Absolutely every year, we see an increase in guard budgets, but they’re not getting more out of it. All this is going to drive automation.”

In the coming years, these types of partnerships could increase, even as manufacturers continue to work directly with end users. At the same time, if deployments of automated security technology expand significantly, integrators will almost certainly become more involved, though one consultant suggested that the growth in leading-edge solutions could result in a split in the integration community between those dealing with “standard security technologies” and those “who specialize only in advanced technologies.”

“They will do access control and video surveillance and camera installation if that’s absolutely necessary, but their main focus is on working with other contractors to do that installation,” he said. “And they come in and they do the very, very advanced technology implementation. So it’s kind of like a very high-tech integrator.”

Some integrators may decide to invest in the training needed to offer drones and robotics services – perhaps, as one manufacturer suggested, starting with smaller firms that are not volume businesses – while others remain content to leave those technologies out of their portfolios.

Or there may be some as yet untried approach that proves successful. Manufacturers indicate that they are as open to innovation in sales models as in technology.

“This is not a commodity that you can sell,” one said. “So [integrators] need to come into the conversation with a little bit more thoughtfulness and say, ‘Hey, I’ve been really thinking this through. I’d like to propose an idea.’ I would love to be able to tap into that untapped resource of other business owners and security practitioners and integrators to come up with something that may be potentially a game changer for both of us.”

This report is produced by the SIA AI, Drones and Robotics Interest Group with support from RAD Security. The SIA AI, Drones and Robotics Interest Group brings together members of the security industry, end users, technology experts and other interested parties to promote best practices regarding the use of autonomous security devices, develop research, offer guidance on legislative and regulatory matters and enhance communication and collaboration.